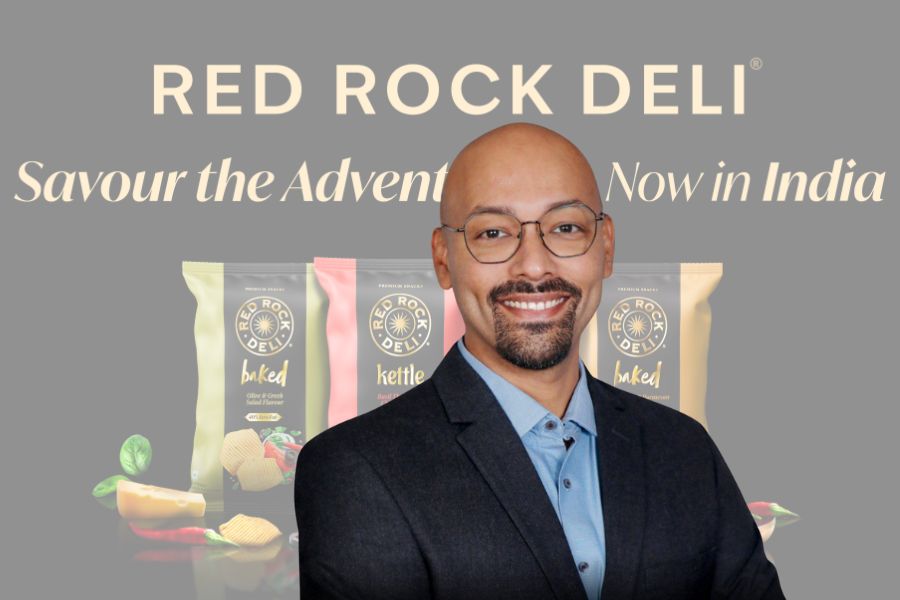

When Sriram Iyer took charge of PepsiCo India’s Quaker and Whitespace Innovations marketing mandate three months ago, Red Rock Deli was already lined up for launch. Its late-November 2025 debut invites an obvious question: was this his trial by fire, or a carefully timed test of whether India’s snacking market—now visibly slowing—still has room for premium disruption?

PepsiCo is positioning Red Rock Deli as whitespace innovation: a gourmet, craft-led brand born in Australia and now localised for Indian palates. It arrives at a moment when the role of snacks in Indian households is being renegotiated. No longer just fillers between meals, snacks are increasingly occasions in themselves and are markers of indulgence, identity and intent. The company’s underlying bet is that this shift in how consumers frame snacking can compensate for a category that has begun to lose momentum.

The headwinds are clear. According to Kantar, India’s overall snack consumption plateaued at 12.8 kg per household in FY25. Volume growth across the snacking category slowed to 4%, down from 9% the previous year. Savoury snacks, long a growth engine, decelerated to 7% from 11%. Analysts cite a familiar mix of inflation, “consumption fatigue” and a lack of meaningful new choices. In that context, premium launches risk being seen less as category expansion and more as a reshuffling of share.

As PepsiCo India’s brand marketing director, Iyer rejects that interpretation, framing Red Rock Deli as a response to existing consumer behaviour rather than an attempt to manufacture it. In his view, Indian consumers are already trading up, by paying closer attention to ingredients and processes while still demanding flavour and experience.

Red Rock Deli’s proposition is designed to sit at that intersection, using sunflower oil across variants, offering three distinct cooking formats, and leaning into globally inspired flavour profiles. The range includes slow-cooked kettle chips, oven-baked chips with 40% less fat, and popped chips that contain vegetables.

The intent, Iyer argues, is not restraint but recalibration. “That’s where Red Rock Deli becomes a natural extension of how Indian consumers are evolving: more mindful, yet curious and adventurous.”

Premium occasions, not everyday munching

Data suggests that this mindset is not isolated. A Farmley consumer insights study conducted at the Indian Healthy Snacking Summit 2025, which surveyed around 6,000 respondents, found that 72% actively seek functional benefits such as better energy, mood enhancement or higher protein. Taste, however, remains non-negotiable: 94% want nutrition without compromising flavour. Meanwhile, 55% prioritise natural, preservative-free ingredients, and two in five respondents said they were willing to pay a 20% premium for healthier options.

Yet, intent does not automatically translate into higher volumes. Premium positioning often struggles with frequency, especially in categories already facing fewer purchase trips. Iyer’s answer lies in reframing when and why people snack.

He points to elevated occasions, like movie nights, weekend unwinds or home-hosting, as moments where consumers are increasingly willing to spend more for a better experience. “Red Rock Deli is designed for these moments,” he says, adding that the aim is to convert existing or emerging weekly occasions into premium ones, rather than displacing everyday snacks.

That distinction is critical. If Red Rock Deli is consumed alongside mass-market snacks, it could add incremental volume and value. If it merely replaces them, it risks becoming another niche SKU in an already crowded aisle. The brand’s success will depend on whether consumers treat it as an addition to their repertoire or a substitute within a fixed consumption ceiling.

Distribution as strategy, not afterthought

The broader market context adds urgency to that question. Bain & Co estimates India’s healthy snack market could reach INR 20,000 crore by 2030. Its analysis also shows food and beverage insurgents grew 3.5 times faster than the overall market between 2019 and 2023, driven by quick commerce adoption, flavour experimentation and social media-led discovery.

PepsiCo’s distribution strategy suggests it is acutely aware of these shifts. Red Rock Deli was launched on Blinkit first, followed by Instamart and Zepto. The sequencing is deliberate. “Quick commerce is leading our launch for a very deliberate reason; it’s where our core consumer already discovers new, premium food experiences,” Iyer explains.

This is not about abandoning traditional trade, but about aligning with consumption behaviour. Iyer describes the target consumer as urban, discerning, digitally engaged and mission-led. In such an environment of fast-scrolling buyers, impulse is triggered less by shelf visibility and more by relevance at the moment of intent.

To that end, PepsiCo plans to rely heavily on retail media triggers, be it search behaviour, basket composition, weather, daypart and location to surface Red Rock Deli in high-intent contexts. Sponsored listings, combo recommendations and nudges aimed at repeat purchase are expected to create what Iyer calls a “repeat-purchase flywheel,” converting one-off curiosity into habit.

What remains less defined is the precise split of volume and marketing investment across quick commerce, modern trade and general trade. Iyer confirms that q-commerce is the first platform of focus, with broader rollout to follow “as per consumer demand.” While that sequencing suits a premium, discovery-led brand, it also raises questions about scalability beyond large urban centres.

Beyond sampling: The frequency problem

Trial, however, is only the first hurdle. Snacking trips declined for the first time since the pandemic, making frequency harder to rebuild. PepsiCo’s approach blends access with aspiration. Availability on Blinkit, Zepto and Instamart lowers friction for trial and re-orders, while a creator-led launch strategy and a cinematic, sensorial brand film are intended to build desire rather than rely on overt value cues.

The peril is that gourmet positioning becomes more visual than habitual; something that is admired, sampled and forgotten. Iyer maintains that the combination of distinctive textures, layered flavours and easy access is designed to generate incremental occasions. Whether that logic extends beyond early adopters remains an open question.

When pressed on year-one volume and value contribution, Iyer avoids numerical targets. Instead, he emphasises softer, but arguably more durable, metrics. Adoption, repeat purchase, digital engagement and the quality of consumer feedback will be the markers of progress.

“True success is when Red Rock Deli becomes a natural part of India’s snacking culture,” he says. For those expecting concrete forecasts, the answer may feel evasive, but it reflects the reality that premium brands often need time to earn habitual relevance.

Communicating authenticity without sounding generic

Credibility is another challenge. With ‘better-for-you’ now a default claim across shelves and screens, differentiation depends on specificity. Iyer’s approach is to anchor communication in process rather than promise.

“Our communication focuses on taste, texture, and ingredient integrity,” he says, arguing that transparency around how the product is made is more credible than abstract functional claims. In a market increasingly sceptical of wellness rhetoric, that restraint may prove more effective than louder assertions.

PepsiCo’s historical strength has been mass reach, but Red Rock Deli requires a narrower lens. Iyer says storytelling will establish the brand’s world and appetite appeal, with food and lifestyle creators driving discovery. At the same time, he is explicit about where the emphasis lies. “The bulk of our energy will stay focused on precision targeting, contextual triggers, and retail media that drive immediate action and repeat behaviour.”

Emotion may open the door, but data is expected to close the sale.

India’s gourmet snacking space is already crowded with insurgent brands built on regional flavours and founder narratives. PepsiCo’s counter is scale combined with craft. Iyer describes Red Rock Deli as “an iconic Australian gourmet snack brand, now made in India, for India,” supported by operational depth and category experience. Whether that combination delivers defensible differentiation will depend on repeat purchase and retention, not launch buzz.

For the wider industry, Red Rock Deli serves as a useful test case. If a multinational can deploy precision distribution, retail media and differentiated product design to unlock incremental premium occasions, it could signal a new phase of growth in an otherwise slowing category. If not, it will reinforce a harder truth: in a plateauing market, even well-crafted innovation has limits.

Either way, the outcome will be closely watched. In a snacking category searching for its next growth lever, this is one launch that carries implications far beyond its packet.