The first half of 2025 has seen India’s advertising economy tilt in unexpected directions, with television holding its ground, print regaining traction, radio deepening its local footprint, and digital accelerating precision-led growth.

Adtech and media planning agency Excellent Publicity, in collaboration with TAM Media Research, TAM AdEx, and RCS India, has released its trends report mapping January to June 2025. Based on data from thousands of publishers, broadcasters, and media networks across platforms, the study provides a snapshot of how brands are recalibrating their media mix.

Describing the industry’s balancing act, Vaishal Dalal, co-founder and director of Excellent Publicity, said that what’s really interesting is how brands are navigating a delicate balance.

“TV still captures attention, radio keeps the connection local and relatable, print is earning back trust, and digital is becoming sharper and more targeted. The brands that truly succeed are the ones that recognise what each medium does best, while staying flexible, innovative, and creative,” she added.

Television retains dominance

Despite recurring forecasts of digital supremacy, television continues to command advertiser interest. Ad volumes in the first half of 2025 rose 27% compared with the same period last year. Spending across TV channels surged 64% over 2023.

Sports and general entertainment channels together accounted for more than 84% of ad time, underscoring the continued pull of mass-reach formats. Prime time slots remained the most contested window for visibility.

Radio posted steady gains, with ad revenues up 10% compared with 2023. Properties and real estate remained the top advertising category, followed by cars. Maruti Suzuki India led advertiser spends, while Jeena Sikho became the most advertised brand.

One standout trend was the rise of commercial vehicles, where ad spending expanded 24 times, reflecting radio’s reach into tier-2 towns and rural markets. These numbers suggest that radio’s ability to deliver hyper-local and vernacular messaging continues to resonate, even as larger categories diversify into digital.

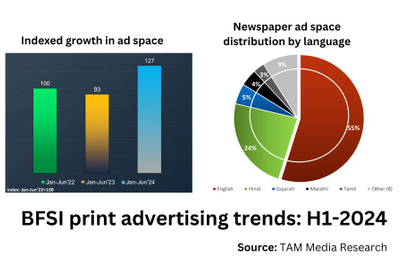

Print stages a comeback

Print, long thought to be in decline, rebounded with a 26% increase in ad volumes compared with the first half of 2023. Cars led spending with an 8.9% share, while retail departmental stores entered the top 10 advertisers for the first time.

Maruti Suzuki India again topped the advertiser list, while Allen Career Institute was the most visible brand. Two-wheelers posted the strongest growth, up 31%, indicating that advertisers are again viewing print as a trusted medium, particularly in inner and suburban markets where newspaper readership continues to be sticky.

Digital advertising consolidated its role as the industry’s most dynamic platform. Active advertisers reached a three-year high, signalling growing confidence in digital-first strategies. Online shopping captured 11.2% of spends, with Amazon Online India as the top advertiser and Amazon as the most visible brand.

Programmatic advertising accounted for 88.3% of digital spend, underlining the pivot to automation and targeted delivery. Within categories, washing powders/liquids expanded 21-fold and perfumes/deodorants grew six times compared with the prior period. The figures highlight digital’s role not just in brand-building but also in shifting consumer categories that traditionally leaned on mass media.

Implications for marketers

The mid-year data underscores a fragmented but evolving marketplace. Television continues to deliver mass reach, but the pace of digital adoption suggests a deeper reallocation of budgets toward programmatic and measurable formats. Radio’s resilience highlights the strategic importance of regional penetration, while print’s rebound shows advertisers are still willing to invest in credibility and familiarity.

Dalal’s observation that each medium is now being defined by its unique strengths points to a broader shift: marketers are moving away from platform-versus-platform debates and instead working to optimise portfolios that balance reach, trust, and precision.

The larger question is whether this balance can hold in the second half of 2025, particularly as festive spending, sporting events, and political activity are expected to spike advertising demand. For now, the numbers suggest an industry that is not converging on one dominant medium but spreading risk and opportunity across four.

.jpg&h=334&w=500&q=100&v=20250320&c=1)

.jpg&h=334&w=500&q=100&v=20250320&c=1)

.jpg&h=334&w=500&q=100&v=20250320&c=1)

.jpg&h=334&w=500&q=100&v=20250320&c=1)

.jpg&h=334&w=500&q=100&v=20250320&c=1)

.jpg&h=268&w=401&q=100&v=20250320&c=1)

.jpg&h=268&w=401&q=100&v=20250320&c=1)

.jpg&h=268&w=401&q=100&v=20250320&c=1)

.png&h=268&w=401&q=100&v=20250320&c=1)