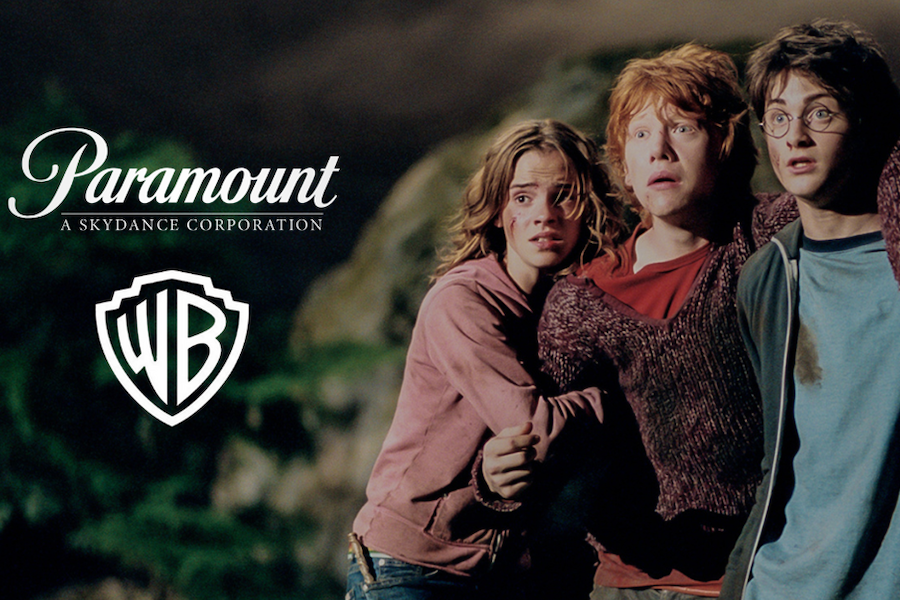

TV network Paramount Skydance has bid $108.4 billion to acquire the entire Warner Bros Discovery (WBD), a counter offer for Netflix’s $83 billion deal to do the same.

This all-cash offer covers the whole company—including the TV business with CNN, TBS, TNT and other networks- and represents a significant premium over WBD’s stock price, offering $30 per share.

Meanwhile, Netflix’s offer values shares at $27.75 and excludes WBD’s traditional TV assets.

Paramount argues that its deal offers better value for shareholders, faster and more certain regulatory approval, and less uncertainty than Netflix’s mixed cash-stock offer and carve-out structure

David Ellison, chairman and CEO of Paramount, said: “WBD shareholders deserve an opportunity to consider our superior all-cash offer for their shares in the entire company.

“Our public offer, which is on the same terms we provided to the Warner Bros. Discovery Board of Directors in private, provides superior value, and a more certain and quicker path to completion.

“We believe the WBD Board of Directors is pursuing an inferior proposal which exposes shareholders to a mix of cash and stock, an uncertain future trading value of the Global Networks linear cable business and a challenging regulatory approval process.

“We are taking our offer directly to shareholders to give them the opportunity to act in their own best interests and maximise the value of their shares.”

US President Donald Trump has raised concerns about Netflix’s proposed takeover, citing potential competition issues and saying he will be involved in the approval process.

A Paramount-WBD merger could also face regulatory scrutiny due to its dominant position in film production and potential industry job losses.

Mike Proulx, Forrester’s VP research director, said: “Since Friday’s announcement, I’ve been sceptical that the Netflix deal would clear regulatory hurdles. Paramount’s hostile takeover bid for Warner Bros. comes as no surprise. The company wants that property badly, and for good reason. Whichever media company, if any, ultimately secures it controls the calculus of the streaming wars and so much more.

“Yet, contrary to the prevailing narrative, if Netflix’s deal for Warner Bros. crosses the finish line, I believe it would be good for streaming consumers through combined cost savings, easier content access, and shorter theatrical windows—all things that consumers want.”

The story first appeared on Campaign's sister title Performance Marketing World.