The media landscape is exploding. Consumers are spending more time than ever across a multitude of platforms, creating unprecedented challenges for brands trying to reach their target audiences before they flit to the next screen.

In conversations with industry heads, the same themes surfaced repeatedly: a shift toward integrated, business-outcome-led solutions, video continued to dominate consumption, macro and nano influencers played a bigger role, blended cross-screen planning gained traction, OOH saw renewed innovation, and India’s rapid digitisation reshaped consumption patterns across markets.

As Amin Lakhani, president, client solutions of WPP Media South Asia, put it to Campaign, “2025 was a year of reset and recalibration for the media industry. Growth became harder to predict; attention fragmented further, and the old playbook of scale at any cost stopped working.”

While each trend touched companies in different ways, they collectively paint a picture of a sector actively reinventing its foundation. Here are the key trends to know:

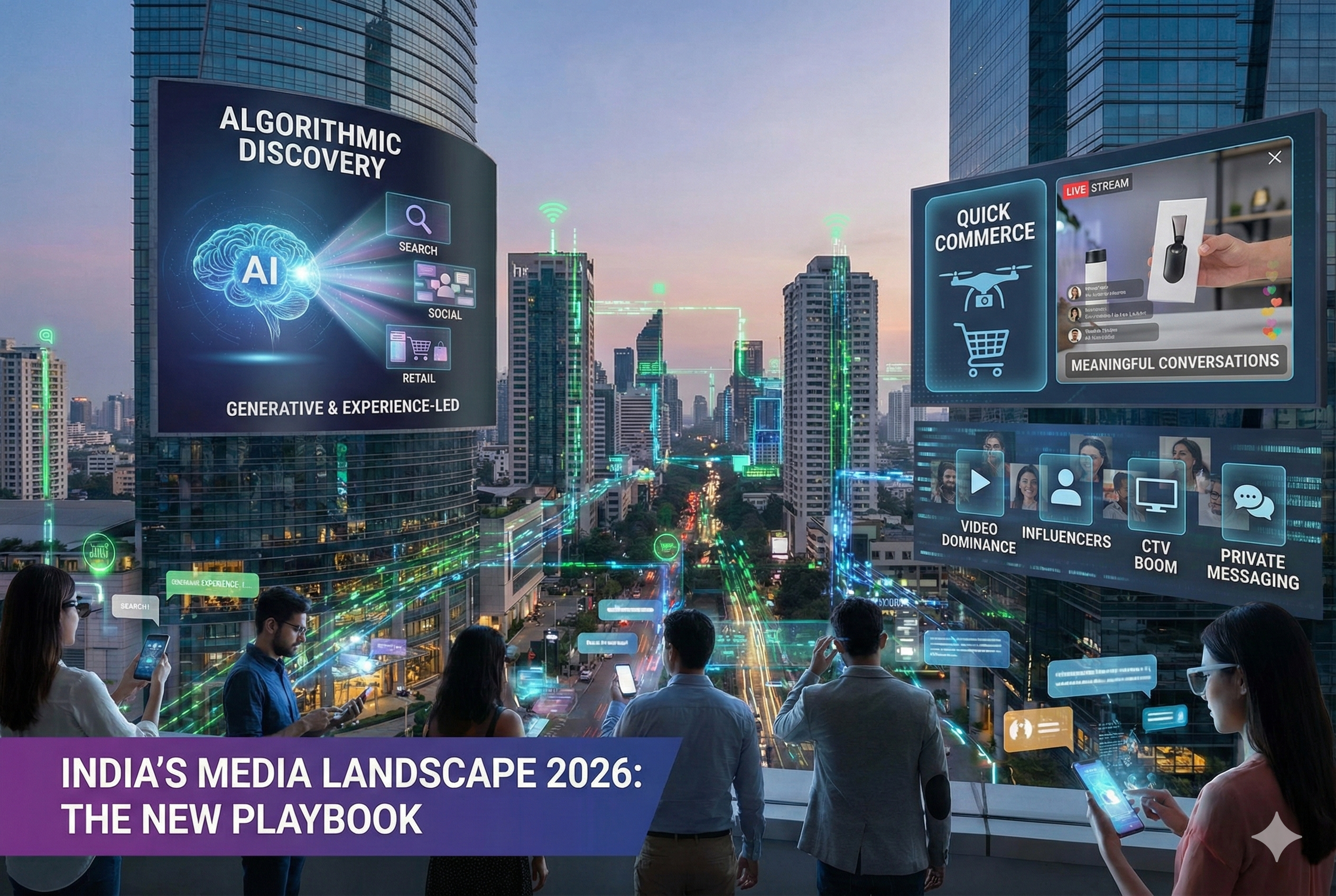

The shift to an algorithmic-dominated world

If the last decade was about mastering platforms, the next will be about understanding systems, said Amit Wadhwa, creative and media brands, dentsu South Asia, highlighting how media is shifting from a platform dominated world to an algorithmic one.

“Discovery is no longer linear, predictable, or owned by a single gatekeeper. It is shaped by AI, retail ecosystems, conversational interfaces, and short form storytelling that responds to context rather than formats,” he told Campaign.

What will change most, Wadhwa said, is how people find and trust brands. “In India, discovery has always been layered across language, voice, culture and context. As generative AI began summarising, recommending and responding directly, discovery, consideration and decision collapsed into a single moment. Media was no longer just about distribution. It became about being present at the moment of decision."

Wadhwa foresees traditional SEO increasingly giving way to generative and experience-led discovery. “In a market like India – multilingual, voice first, and deeply contextual – visibility will come less from rankings and more from credibility. Brands will need to show up meaningfully across search, social, retail, and AI-led interfaces, not as noise, but as a trusted presence,” he shared.

Attention needs to be rewarded with meaning

Bhushan Kadam, senior vice-president, creative and strategic initiatives at White Rivers Media, predicts that in the new year, the conversation will not be about platforms or formats but how attention is engineered.

“Undivided attention is no longer the norm. Audiences graze content across screens, formats, and moments. The smartest brands will stop fighting this and start designing for it. Content needs to be legible quickly, easy to enter mid-stream, and valuable even in fragments,” he said.

Ishwinder Arora, vice-president, marketing at Junglee Pictures, agreed but added that strong entry points only work when followed by meaningful substance. “Exposure without depth no longer delivers impact. The success of Bollywood film Dhurandhar proved that high-quality, distinctive content generates organic virality. Ordinary content, even if strategically seeded, cannot be engineered into cultural traction. In 2026, the winners will be brands and films that earn attention quickly, and reward it with meaning,” she said.

Kadam believes brands are moving away from one-off moments toward episodic thinking as a structure. “When content is designed in chapters, it builds familiarity and expectation over time. That continuity creates memory, not just reach,” he explained. “One-off spikes still matter, but they do not compound meaning. In India, where audiences are already conditioned by serial entertainment, creator-led IPs, and daily social rituals, this shift is less a creative leap and more a strategic alignment with how attention has always worked.”

The rise of commerce media

With quick commerce, marketplaces and delivery apps, the time from ad exposure to transaction has shrunk to minutes, allowing brands to see clear, real-time impact at the point of sale. First-party data and retail media strategies have become sharper and more integrated with commerce in 2025, said Navin Khemka, president–client solutions at WPP Media South Asia.

The ease of commerce to turn an ad exposure into a shopping moment is leading advertisers to rejig their budgets to focus more on this channel. According to WPP’s latest global ad spends projections, commerce-driven advertising will hit $178 billion in 2025, overtaking total TV ad revenue for the first time.

While India remains largely a TV-driven economy, commerce media is definitely on an upward trajectory. In the new year, Khemka anticipates increased regulation for retail media, particularly within the fast-growing quick commerce ecosystem.

In an earlier interview with Campaign, Lalatendu Das, CEO, Publicis Media South Asia, mentioned that as quick commerce grows at an “astonishing” pace—over 25% in 2024— contextual advertising will become its defining differentiator.

The technology to enable this exists, via integrations with Meta, The Trade Desk and multiple publisher ecosystems that track purchase patterns, affluence markers and micro-behaviours. But the barrier, Das emphasised, is organisational. Marketers often demand personalisation but lack the supporting discipline: structured data, interoperable systems, or aligned internal metrics.

Connected TV to continue its boom

In 2024, Vikram Sakhuja, partner group CEO, Madison Media and OOH, predicted that Connected TV (CTV) would continue to eat into cable and DTH – a prediction that came true. The recent Kantar Media Compass report found that the number of viewers who are watching content on both LTV (linear TV) and CTV has grown to 116 million in Q3 2025 - a growth of 17% over Q1’2025; 49% of the incremental CTV viewers are from rural India.

A GroupM report in February last year had predicted this boom. That report had mentioned that addressable TV homes would surpass 45 million by the end of 2024, covering 21% of Indian TV homes. They also highlighted how two-thirds of respondents believed ads on OTT services were more appealing and relevant than their linear TV counterparts, and how 41% were willing to view ads on OTT service to reduce subscription costs.

Sakhuja believes CTV will continue to be a force to reckon with in 2026, particularly if the industry can put a cross media measurement structure in place.

AI will move from experimentation to becoming the operating system

Over the last 12 months, AI adoption has accelerated across creative, planning and operational workflows, significantly improving efficiency by reducing timelines from weeks to hours. “It has enabled unprecedented scale, empowering brands to create high-volume, multi-format content tailored for diverse markets and channels. Importantly, it has enhanced marketing effectiveness, driving improvements in metrics such as cost per acquisition, purchase intent and incremental revenue,” shared Khemka.

Given this evolution, Wadhwa believes that media planning itself will evolve as AI-generated audiences allow marketers to learn faster, test smarter, and understand complexity at scale, especially in a country as diverse as India.

Sakhuja had predicted last year that marketers would move from cohort targeting to broad targeting where they read response signals and use ML/AI to scale. While this did happen, he said the way it happened was potentially tectonic. “Control moved from Advertiser to Big Tech,” he explained. “Advertisers reduced reliance on A Priori Cohort targeting to giving the budget to Big Tech and letting them use their AI to develop creative and target for best results.”

However, in 2026, he expects that big advertisers will feel uncomfortable with the ceding of control of their budgets to Big Tech and will want to regain control.

Seeking simplicity in complexity

A recent study published in The Financial Times, which surveyed as many as 2,50,000 online users across 50 countries, found that users aren’t posting photos, Reels or Stories anymore. Instead, driven by exhaustion from noise, ads and curated perfection, they’re saving, bookmarking and posting to private groups. This trend signals a major shift in online behaviour, moving away from personal broadcasting to selective engagement, even for platforms like Instagram.

Wadhwa believes in 2026, as everything becomes faster and more frictionless, brands will respond by reintroducing intentional moments of pause. Limited drops, curated access, and experiences that feel earned rather than pushed will return. Not as gimmicks, but as ways to restore meaning and desire in an over efficient world.

“Messaging platforms will quietly become one of the most powerful growth channels,” he predicted. “With their intimacy and high engagement, they will sit at the heart of commerce and customer experience, blurring the lines between marketing, service, and relationships.”

Looking ahead… Industry heads place their bets

Industry stakeholders believe that the technology narrative will continue to be driven by Big Tech, and they will increasingly control how budgets are to be deployed despite advertisers resisting loss of control. Sakhuja also foresees the pendulum shifting from performance to branding should cross media measurement occur or if there is a more holistic effectiveness measurement system that combines MMM with incrementally testing.

For Khemka, a reset in cricket media rights and bidding dynamics is imminent, which will significantly influence the sports marketing landscape. He also anticipates that on the consumer side, digital detox behaviours will continue to gain momentum as people consciously rebalance their time online and offline.

Junglee Pictures’ Arora sees a dip in brands depending on star power to build engagement as they redirect their focus to strong content. “We saw this with Saiyaara and Ek Deewaniyat. One with zero-star involvement during on-ground promotions; the other with aggressive promotions, but it was content, not visibility, that ultimately connected with audiences. The biggest mistake heading into 2026 will be assuming that star power or more and faster content automatically builds relevance.”

In 2026, Lakhani foresees attention becoming the true currency with brands investing across a collapsed funnel, rebuilding top-funnel memory structures alongside performance and commerce, especially through quick-commerce and retail media. He also predicted that first-party data and privacy-by-design systems will shift from being ‘nice to have’ to non-negotiable, as compliance, trust, and intelligence converge.