Franklin Templeton India has brought its nationwide investor awareness initiative, ‘Change the Soch– Kanyakumari to Kashmir Drive’, to Bengaluru as part of a 30-day journey across 21 cities. The campaign marks the company’s 30 years in India and aims to demystify mutual fund investing through in-person education.

The drive began in Kanyakumari and will conclude in Srinagar, Jammu & Kashmir. It is led by Avinash Satwalekar, president, Franklin Templeton India, who is hosting investor education workshops every alternate day across towns and villages. The sessions focus on savings, investing and long-term wealth creation.

The initiative targets a wide demographic, with a majority of participants being women. These include farmers from fishing and agricultural communities, students, parents, teachers, self-help group members in food and handloom sectors, entrepreneurs, private and government employees, and personnel from the army, navy and police.

Satwalekar said, “Financial literacy among women is fundamental to India’s long-term socio-economic progress. While urban centres have made meaningful advances, lakhs of women across Bharat, especially in Tier 2 and Tier 3 regions remain underserved in terms of access to financial knowledge and tools. Through this initiative, we will engage with women from diverse walks of life and empower them with the knowledge and confidence to save, invest and adopt digital finance.”

He added, “When women make informed financial decisions, households could become resilient, communities could thrive and the country moves closer to inclusive growth. Bridging this gap is more than education – it is a vital step towards India’s ambition of Viksit Bharat by 2047 and building a more inclusive and sustainable financial ecosystem.”

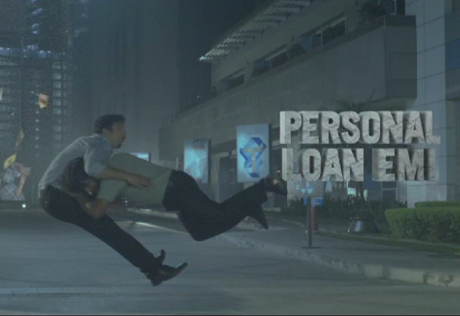

The campaign functions as a long-term brand-building exercise rather than a product-led promotion. It positions Franklin Templeton as an educator in a category often perceived as complex and inaccessible.

Karnataka is among the top 50 markets in terms of industry assets under management. The state’s mutual fund industry AAUM stands at over INR 564,488 crore, having grown over 17% in the previous year, with Bengaluru, Mangaluru, Hubli, Raichur and Mysuru contributing to growth.

India’s mutual fund industry AUM has expanded from INR 12.75 trillion in December 2015 to INR 80.23 trillion in December 2025, reflecting a 20% annualised growth rate. Franklin Templeton manages average assets of over INR 1.27 lakh crore across 37 schemes in India.