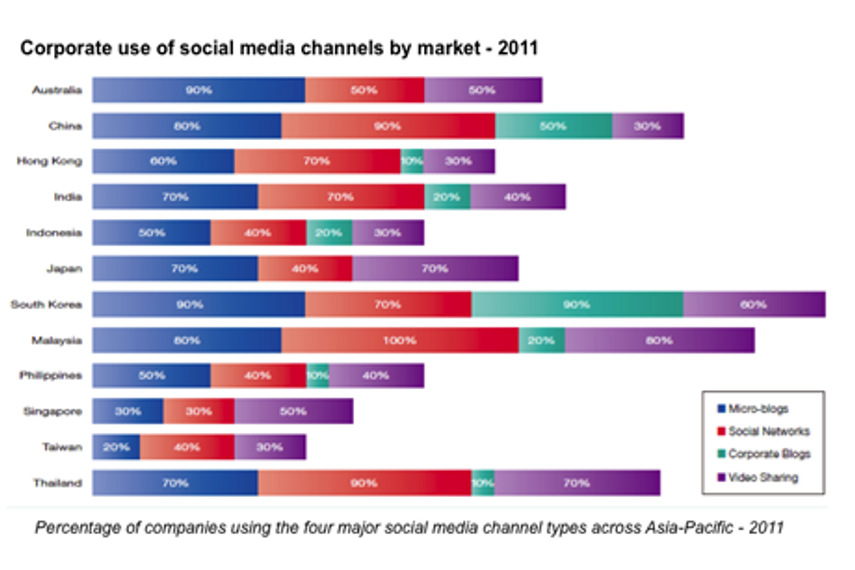

Over 80 percent of 120 companies listed on The Wall Street Journal's Asia 200 Index are present on social media, compared with 40 percent last year, according to the 2011 Asia-Pacific Corporate Social Media Study by Burson-Marsteller.

The study reviewed and analysed social media activities of the top 10 major companies across 12 markets in Asia-Pacific, namely Australia, China, Hong Kong, India, Indonesia, Japan, Malaysia, Philippines, Singapore, South Korea, Taiwan and Thailand. The companies were selected based on their rankings in the 2010 Wall Street Journal Asia 200 Index.

Markets showing the strongest growth over the past year in social media use include Malaysia, Thailand and the Philippines while Taiwanese and Singaporean firms lag behind their peers and competitors in other Asian markets.

The increased number of Asian multinationals using branded social media compared with last year places the region on par with Fortune 100 companies, where 84 percent use social media, said Bob Pickard, president and CEO of Burson-Marsteller Asia-Pacific. However, the use of social media for engagement remains low. "There’s a long way to go when it comes to community engagement in cultures where ‘face’ remains more important than Facebook,” he added.

The study found that a third of activity in the region focused on basic media and influencer outreach, as opposed to engagement, with the exception of South Korea and China. Only nine per cent of firms surveyed used their corporate blogs for corporate marketing and communications.

Furthermore, many corporate social media sites in Asia still do not allow public comments by users on their websites, and what is allowed is heavily moderated, commented Craig Adams, Burson Marsteller's director of marketing for Asia-Pacific in an interview with Campaign. "We believe this will change in the coming year with more and more companies making the change from merely pushing out information towards creating conversation."

This strategy puts corporate Asia at risk of social media crisis as they are unable to develop and protect their brands by controlling social media conversations, observed Charlie Pownall, Burson-Marsteller’s lead digital strategist for Asia-Pacific. “Asia-based corporate decision-makers expect web-based crises to impact their businesses over the next twelve months; hence we expect a much sharper focus on proactive reputation management and greater participation in online conversations going forward.”

Overall, Asia's corporate media strategies tend to remain short-term and piecemeal, said the study. While corporate marketing take advantage of about 38 per cent of available social media platforms, with 31 per cent using three or more social media platforms, over half of these branded accounts remain inactive - rarely updated after the initial campaign has ended.

While Australian, South Korean and Malaysian firms are actively promoting their social media activities on their websites, most firms (62 per cent) are failing to integrate their social profiles with their corporate websites, observed Adams. "We see a change happening there with more companies choosing to integrate their official online presence with social media as they grow more comfortable and familiar with the medium."

An under-used social media channel, said Adams, is video. Only 12 percent of companies surveyed in Asia use the medium compared with 57 per cent of Fortune 100 companies. “Many of our clients in the US and in Europe use video and there is definitely opportunity for Asian firms to do likewise," he said.

"To reach and persuade stakeholders today, it is not just the vocabulary and tone of corporate marketing and communications that must evolve,” said Pickard. “Companies must adopt a mindset that puts listening and acting genuinely and transparently front and centre. They also must understand how to deal with negative feedback expressed publicly that could resonate and escalate.”

This article first appeared on Campaign Asia-Pacific.

.jpg&h=334&w=500&q=100&v=20250320&c=1)

.jpg&h=334&w=500&q=100&v=20250320&c=1)

.jpg&h=334&w=500&q=100&v=20250320&c=1)

.jpg&h=334&w=500&q=100&v=20250320&c=1)

.jpg&h=334&w=500&q=100&v=20250320&c=1)

.jpg&h=268&w=401&q=100&v=20250320&c=1)

.jpg&h=268&w=401&q=100&v=20250320&c=1)

.jpg&h=268&w=401&q=100&v=20250320&c=1)