Please sign in or register

Existing users sign in here

Having trouble signing in?

Contact Customer Support at

[email protected]

or call+91 22 69489600

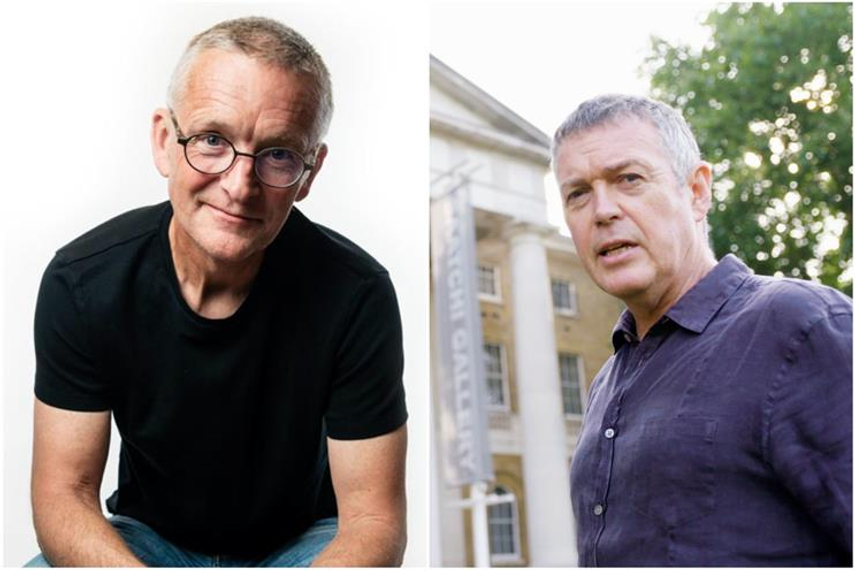

Deal comes days after M&C Saatchi directors rejected rival offer from Vin Murria's AdvancedAdvT

Contact Customer Support at

[email protected]

or call+91 22 69489600

Top news, insights and analysis every weekday

Sign up for Campaign Bulletins

YouTube Shorts has stopped being an experiment and started becoming essential.

The partnership introduces an on-chain model for evaluating, financing and distributing entertainment IPs across key global markets.

The nationwide 13-day customer initiative is designed to introduce its latest models through immersive dealership experiences.

Sources tell Autocar and Autocar India that designer Gerry McGovern was asked to leave the firm this week.