Please sign in or register

Existing users sign in here

Having trouble signing in?

Contact Customer Support at

[email protected]

or call+91 22 69489600

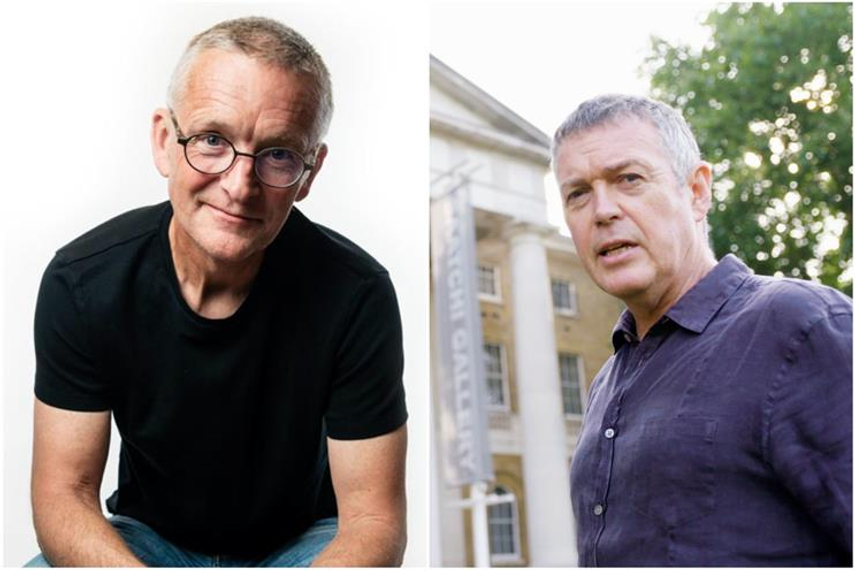

Deal comes days after M&C Saatchi directors rejected rival offer from Vin Murria's AdvancedAdvT

Contact Customer Support at

[email protected]

or call+91 22 69489600

Top news, insights and analysis every weekday

Sign up for Campaign Bulletins

The prescriptive ad intelligence system is designed to help marketers shift from data analysis to actionable decisions.

The limited-edition collection is inspired by resilience and the process of rebuilding.

It has collaborated with Janhvi Kapoor to strengthen its positioning in India’s growing high-protein snacking market.

Working with Punt Creative and AI music platform Suno, Little's put together what might be one of the biggest children's music releases in recent memory. The album covers seven Indian languages, multiple genres, and different moods, basically trying to have something for every possible baby situation parents find themselves in.