While employees from several companies have been able to work remotely last year, the ones in the logistics and supply chain space haven’t been that fortunate. They had to be on-ground delivering essentials and other goods. Sandeep Juneja, VP – sales and marketing DHL Express, explains how the company operated in the last year, how marketing tie-ups have worked, and more…

Editor’s note: This interaction took place before the IPL was suspended.

Excerpts:

You have spent 16 years with DHL. How have the company and the logistics market changed over those years?

Before this 16-year stint, I was working for a Swedish engineering company for 11 years. There’s a reason I’m telling you this: when I worked at the engineering company, there was no point at which I thought about the supply chain. Speaking to anyone from logistics from my company was never a priority. It’s my observation that procurement and logistics teams sat out of basements of multi-level buildings.

Then, as fate would have it, I joined a logistics company.

And now, over time I have seen that the logistics teams don’t sit in the basements anymore. Many offices have a chief supply chains officer who sits on the company’s management board. In India, specifically, the logistics cost is very high. People are realising that logistics means unlocking costs; this adds to the competitiveness and the value that you offer in the market.

And speaking of the market, we see that when B2C consumers order on e-commerce, they are anxious till the shipment arrives. If the shipment arrives later than expected, the whole experience suffers. And the situation becomes far more complex when it’s cross-border.

I’d say supply chain and logistics has really evolved and companies today know that if they want to have the cutting edge in their service proposition, logistics have to fall in place. So, the talent in these organisations has shot up too.

Digitisation has come in too. Logistics is a huge business enabler, today. For example, cross-border and local e-commerce has shot up too.

In total, the B2C e-commerce volumes within the DHL Express network increased in 2020 by approximately 40%, compared to 2019. What it gained in about seven years, was matched in one year. E-commerce providers can’t achieve this without logistics. In e-commerce, that’s the main thing. So, logistics has seen dynamic movement and there’s more to come.

The e-commerce space has also seen several more logistics partners growing. There are homegrown ones too like Delhivery and Xpressbees that have come up. Would you consider them to be DHL’s competition?

One of the bigger challenges in e-commerce is the first mile and last mile. More so when we are talking about e-commerce which is B2C. In B2C, where are the consumers? They are at their residences most of the time – more so in the lockdown. With the advent of the internet, and more importantly, mobile phones, reaching the rural economy with a way buying more and more, the first mile and last mile from a rural standpoint becomes a challenge.

When you pick up any domestic logistics company, they are strong with this. They have typically grown from a B2B backbone because B2C wasn’t big. Now, one can’t be in only a select few big cities, because demand is also coming from outside them. That white space or empty space allows other players to come into the market. The sheer volumes of e-commerce are so high that it allows headroom for people to step in.

From an India perspective, the new players that have come in are finding their place.

The novelty with new players coming in is that they bring with them new methods of doing things and in a way, they shake up the system. It’s like a small shark in the tank because every fish becomes more efficient as they are trying to save themselves.

The real challenge comes when you start becoming bigger. You need to be present in all the cities and have quality people, IT, cargo planes, and more. The moment you go international it means being present in 200 plus countries, 1,50,000 destinations and it becomes more complex.

Fortunately for us, we’re a nimble organisation that’s externally oriented. This means we listen to our customers and make changes while maintaining global standards; you can’t have 200 different global software working together. Last year, despite such a tumultuous year, our DHL business globally grew by about 12% to 19 billion euros. Our profits grew by 35% to about 2.7 billion euros. This shows that as the e-commerce wave is growing, as demands are increasing, the companies that have solid infrastructure globally with digital awareness are far more ready to serve the market. When you serve the market, it shows in your results.

How was the last year for DHL’s India operations? How did the first lockdown affect the company? With travel reduced, were Indians looking to shop from global websites during the year?

India is connected to the cross-border trade fairly well though the cart value of the Indian consumer is smaller. So, while Indians are making purchases online on global sites, they are more volume products than high-value products.

India saw a huge jump in cross-border e-commerce last year. In my estimates, the cross-border e-commerce volumes would have jumped by more than 50% last year. This is huge. I saw many new entrepreneurs jumping on the cross-border wagon. Every month new companies were coming up, setting shops and starting exports from India.

Taxation on cross-border e-commerce is quite high. For example, there are football fans I know who are sceptical about buying club merchandise from sites abroad. Is that a trend you’re observing?

Yes, this is one trend. In the US, if you have to order anything, up to 800 dollars of purchase see no custom duty. This is a fairly large value for a retail buyer.

Different countries have different de minimis depending on the development cycle they’re in. Without naming any country, but considerations like a certain country is dumping their cheap goods into our country and questions about whether it will make a country’s manufactures uncompetitive are there. India follows World Trade Organisation (WTO) rules, but there’s a balance they strike between globalisation and promoting local business. Within that balance sometimes there exist pressures for import duty.

On the retail front, sites selling products to India should be looking to condition their pricing accordingly. If they are selling to India, they should take that effort for a person who has logged in from an Indian IP address and ensure they will see prices in INR, including the exchange rate, and bill that in the product.

So, yes cross-border purchases can get daunting, but the seller should be looking at easing this for the customer.

Any other trends or learnings that emerged during the last 12-15 months?

One step jump that happened last year – both for sellers and buyers, is the adoption of technology. The whole country has seen this. Digital payments have also shot through the roof. The speed of digitalisation has shot up. At DHL, we are seeing this too. We are looking at AI, ML, robotic processes to make it more efficient.

The other phenomenon which is happening is that most of the B2B decision-makers are millennials and most of their habits have been formed by their experiences on B2C.

First, a person would research and talk to five or six suppliers and they would be called for presentations. Today, 85% of these buyers are doing the purchase journey on digital mediums. But, are the sellers ready? Therefore, one of our big marketing initiatives is around B2B e-commerce. We are holding conversations digitally, socially, in person with our customer base so that we make them ready and aware of the possibilities of growth in e-commerce.

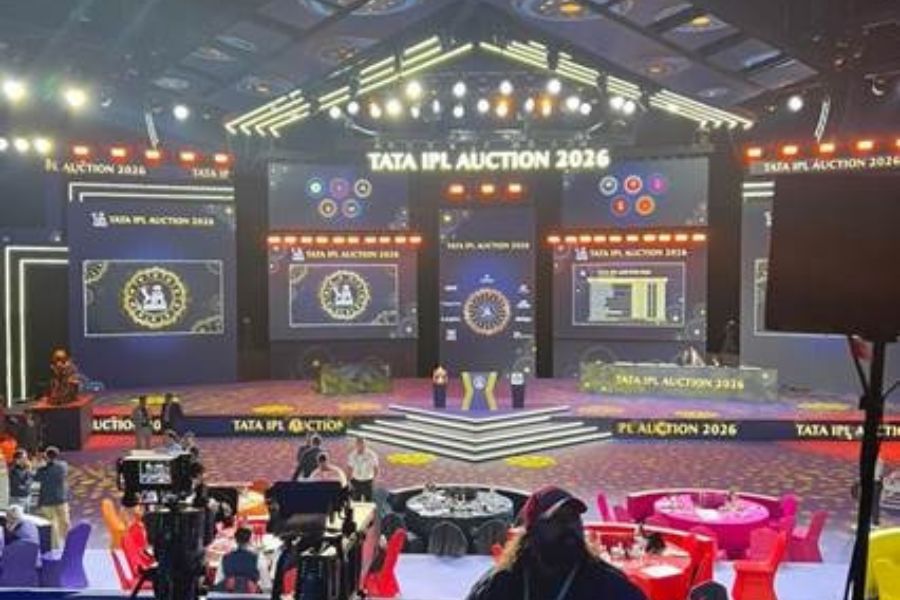

You partnered with the IPL as a sponsor of the Mumbai Indians this year, making it your first tie-up with cricket. Considering DHL is a global sponsor for other sports, why did it take so long to enter the cricket sponsorship space in India?

Globally, the properties that we pick up are based on global interest. The number one sport globally is football. We have partnered with football clubs in Germany, UK and Latin America. Global marketing teams look at a property that is present in 60-70 countries at least. We started working with Cirque de Soleil at a time when it was present in more than 50 countries. We work with F1 which is also a global sport.

All these properties were big globally.

While cricket is a religion in India, it’s still a Commonwealth country game. Therefore, when we started it was easy to pick up the global sport and sponsor the ISL (Indian Super League).

Over a period of time, we were always interested in doing something in cricket. Our job is to connect Indian businesses to the world. At the core, while we are also doing business, we are supporting global trade for the Indian economy. To do business in India you need to look at properties that are big in India and it was impossible to stay away from cricket.

T20 is a super exciting format. It has fantastic followership and is taking over other formats. DHL at the core lives by certain values – speed, passion, teamwork, can-do attitude, and being ‘first time right’. If you don’t do things the first time right in supply chain it can have a big impact down the line. Speed identifies with T20. Passion, can-do attitude and teamwork also resonate with cricket and the IPL. So, fundamentally the values work.

We are becoming part of living room conversations by partnering with a popular sport, and the most popular team within that sport.

DHL is also a partner of the ISL as an associate sponsor and has been so for six years. How has that partnership worked?

I won’t compare what we are doing with the Mumbai Indians in the IPL to the ISL. They’re different properties altogether. But, quite frankly our association with the ISL has been very good and worked for us. Our RoI has been fantastic. If we look at the true bang for our buck, the ISL has delivered.

The experience in different cities, in stadia, digital engagement, and on television, has been much better than the expectation and is getting better.

Despite all the games played behind closed doors in Goa last season, it delivered for us.

Other than the lockdown what are the other challenges the industry faces?

From an Indian perspective, the first challenge that every industry faces is quality people. Fortunately, for us, we are a great place to work. We were ranked number two in the country. That allows us to instil pride in our people and also allows us to attract talent into our organisation.

Also, we have worked closely with the government to ideate and figure easy ways of doing business. Several changes are happening in the regulatory and customs clearances environment.

But if I was to put a wish list, it would be about better cargo infrastructure at the airports, lesser dwell time for customs clearances, more automation. Custom clearances are complicated – you’re opening your border for things to come in and we need more automation and trust-based.

Also, within the country, the infrastructure which aids the faster movement of goods, would be required.