Please sign in or register

Existing users sign in here

Having trouble signing in?

Contact Customer Support at

[email protected]

or call+91 22 69489600

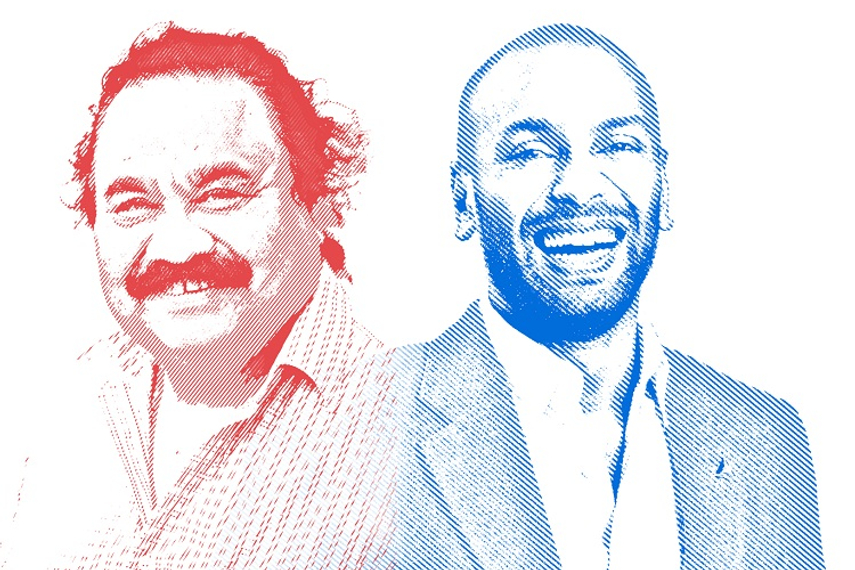

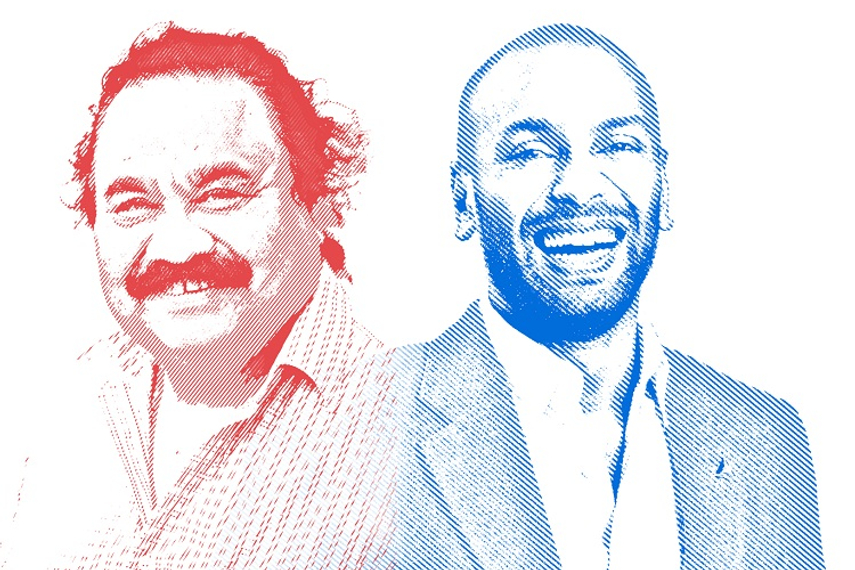

Sandeep Goyal and Projjol Banerjea of Mozeo discuss the opportunities with programmatic advertising in India

Contact Customer Support at

[email protected]

or call+91 22 69489600

Top news, insights and analysis every weekday

Sign up for Campaign Bulletins

With his rugged charm and pan-India appeal, he became one of advertising’s most bankable stars, speaking to the India that lay beyond the metros.

With the $13.5 billion deal now awaiting its final EU approval, we break down the key milestones that have shaped the industry-defining merger.

Following a historic antitrust victory in September, the DOJ argued that Google’s dominance in adtech cannot be fixed with promises or fines alone.

Process has taken nearly three years.